The Philippine real estate market is a beacon of stability and growth despite global economic uncertainties. One key factor fueling this resilience is the rise of joint venture models. These models are not just for large corporations; they also offer opportunities for individual landowners, investors, and small to medium-sized developers. Through joint ventures, parties pool resources, share risks, and leverage each other’s expertise, creating a mutually beneficial landscape.

This optimistic outlook is supported by a 2023 report from property consultant JLL Philippines, highlighting the market’s strong macroeconomic fundamentals. These fundamentals have helped sustain the country’s economy, even facing challenges such as soaring inflation rates and the lingering effects of the 2021 slowdown.

However, it’s important to note that inflation and interest rates influence the real estate sector. Data from the Philippine Statistics Authority shows that headline inflation rose slightly from 8.0 percent in November 2022 to 8.1 percent in December 2022, impacting the housing sector with a 6.4% markup. Additionally, Bangko Sentral ng Pilipinas forecasts a 25-50 base point increase in interest rates, making borrowing more challenging. Despite these hurdles, industry experts view the real estate market favorably, recommending Real Estate Investment Trusts (REITs) and property investments over stocks as a more stable option.

What is a Joint Venture in the Context of Philippine Real Estate?

At its core, a joint venture in this context typically signifies a strategic alliance between a landowner and a property developer. The landowner contributes the essential real estate for the project, often a parcel of land that holds potential but remains undeveloped. On the other side of this alliance, the property developer injects financial capital, invaluable industry expertise, and the necessary resources to bring the project to fruition.

A joint venture distinguishes itself from other business arrangements like partnerships through its temporal nature. Partnerships usually suggest long-term business relationships with indefinite shared responsibilities and benefits. In contrast, a joint venture typically has a finite lifespan. Parties design it to achieve a specific goal, such as developing a residential complex or a commercial plaza. The joint venture dissolves once they reach this goal and complete the project successfully. Each party takes its share of the profits and ends the business relationship unless they decide to undertake a new project together.

This project-specific focus allows for a high degree of flexibility, enabling both parties to tailor the terms of the joint venture to suit the unique requirements and challenges of each real estate development endeavor. This adaptability, combined with the shared risks and rewards, makes joint ventures an increasingly popular choice for both seasoned and newbie players in the Philippine real estate market.

Legal Frameworks and Agreements

Joint ventures adopt various legal structures similar to creating corporations and partnerships. Yet, most real estate joint ventures function within the confines of a contractual joint venture agreement. This critical document spells out the roles, responsibilities, and obligations that each party must fulfill. It also delineates how both parties will share profits and specifies the strategies for exiting the venture.

Due to the intricate nature of these agreements, parties usually consult legal experts to draft the document meticulously. Legal professionals also review the deal to ensure it aligns with both parties’ interests and complies with Philippine laws. This legal scrutiny safeguards the interests of all involved, minimizing the risk of future disputes or misunderstandings.

The agreement often includes clauses that address contingencies, such as what happens if one party wants to exit the venture early or if the project faces unforeseen challenges. These provisions add another layer of security and clarity, making the contractual joint venture agreement a cornerstone for successful real estate collaborations in the Philippines.

Understanding the Concept of a Joint Venture

Before diving into the real estate market, it’s crucial to understand what a joint venture is. In the simplest terms, a joint venture is a business setup where two or more parties collaborate to achieve a specific goal. This collaboration often involves a landowner and a developer working together to complete a property development project.

Why Consider a Joint Venture?

The concept of a joint venture in real estate offers numerous advantages that make it an attractive option for proponents, landowners, and investors. Here are some key reasons why a joint venture might be the right choice for your next real estate project:

- Resource Optimization: One of the most immediate advantages of a joint venture is the ability to pool resources. This collaborative approach allows for sharing financial capital, workforce, expertise, experiences, strategies, and even technology, creating a synergy that can lead to enhanced opportunities. With more options, you can undertake more extensive projects, access better market positions, and employ more advanced frameworks, ultimately leading to superior project outcomes.

- Risk Sharing: In any real estate development project, risks such as financial uncertainties, operational challenges, and market fluctuations are inevitable. However, a joint venture is a strategic approach to mitigate these risks effectively. By partnering with someone who brings creativity, an extensive network, and agility, the business venture inherently becomes more resilient to these challenges. Rather than navigating the complexities alone, each party benefits from a partner with the expertise and resources, reducing the overall risk profile of the project. This collaborative approach allows for a more secure and confident venture, where the focus shifts from merely managing risks to seizing opportunities for success.

- Expertise Access: A joint venture often brings together parties with complementary skills and expertise, creating a well-rounded team capable of tackling all aspects of a real estate project. For instance, a landowner may have a parcel of idle land acquisition, while an investor might have excess capital, and a developer consultant excels in master planning and project management. By joining forces, each party can benefit from the other’s assets, leading to a more efficient and effective project execution. This sharing can also extend to achieving compliance, providing a comprehensive pack that can significantly enhance the project’s success.

Steps to Form a Joint Venture in Real Estate

Embarking on a joint venture in real estate requires a strategic approach, especially for diverse projects from townhouse developments to mixed-use townships. Collaborating with experts in joint venture setups who bring a strategic mindset, a reliable network of professionals, and a range of investor partners to the table is advisable. These experts can assist in crafting well-planned business strategies and offer comprehensive design and development capacities, from master planning and architectural design to construction, brokerage, selling, and operation.

Should you be a landowner seeking to enhance liquidity or an investor pursuing dependable real estate opportunities in the Philippines, your inquiries are most welcome. I invite you for a comprehensive consultation to explore the many possibilities a joint venture setup can offer.

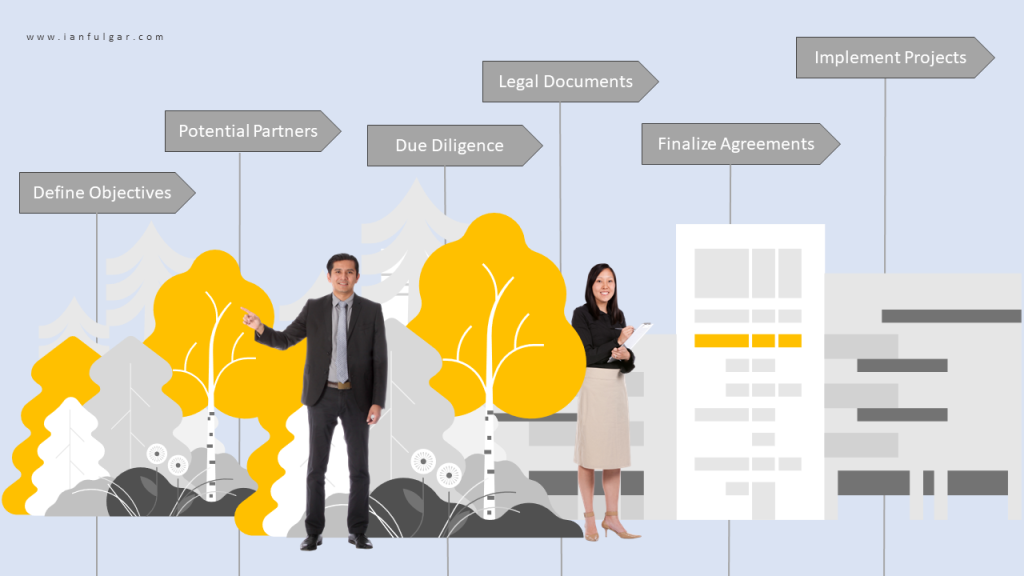

Here’s a roadmap to guide you:

- Define Objectives: The first step involves clarifying your goals. Whether you’re interested in residential or commercial development, a well-defined objective lays the groundwork for a successful joint venture.

- Identify Potential Partners: The subsequent step is to find partners whose skills, resources, and objectives align with yours. This alignment is crucial for the venture’s success.

- Conduct Due Diligence: Before formalizing any partnership, you must investigate your potential partner’s professional stability, reputation, and track record in real estate. This check ensures you enter a business relationship with a reliable entity.

- Prepare Legal Documents: Once you’ve found a potential partner, it’s advisable to seek legal drafts of the joint venture agreement. This document will specify roles, responsibilities, profit-sharing mechanisms, and exit strategies.

- Finalize the Agreement: After the legal experts draft the agreement, both parties should review and, if necessary, understand the terms before finalizing it.

- Implement the Project: With a signed agreement, the implementation phase can begin, covering all aspects of selling, construction, and development.

If you’re considering such a venture, my expertise in joint venture setups can provide invaluable insights and resources to ensure the project’s success from start to finish. With a team of reliable partners in the industry, we can turn your property into a lucrative real estate venture, making it an essential part of your strategic planning.

Strategies for Amplifying Profits in Real Estate Joint Ventures

Real estate joint ventures offer a multifaceted platform for financial growth, suitable for landowners and investors. The secret to opening this potential lies in a nuanced understanding of critical factors, such as project scale, property typologies, market demand, innovative business models, and strategic planning.

Leveraging Scale for Financial Gains

The project’s scale can be a game-changer in determining the return on investment. Large projects like mixed-use developments often require substantial complexities but promise lucrative long-term returns. On the other hand, smaller projects like townhouses can be less extensive and offer quicker returns, allowing you to scale your investments over time.

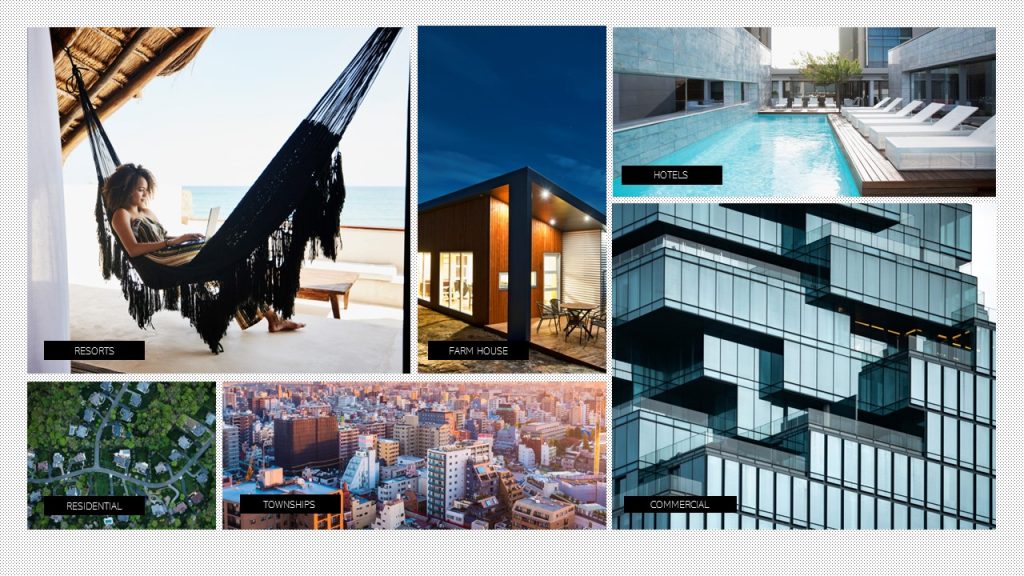

Opting for the Right Property Typology

The choice of property type can significantly impact the joint venture’s profitability. Commercial properties, for example, can offer a steady income through long-term leases, while residential properties may provide quicker but competitive returns. The key is to align the property type with market demand and your investment strategy.

Capitalizing on Market Demand

Understanding market demand can give your venture a competitive edge. Whether the market is leaning towards sustainable housing, farm resorts, hotels, or luxury apartments, aligning your project with these trends can accelerate sales and enhance profitability.

Adopting Flexible Business Models

The choice of business model can also influence the venture’s financial outcomes. Options like build-to-rent and build-to-sell cater to different investment strategies and have their economic dynamics. The joint venture agreement should specify each party’s contributions, individual responsibilities, and how to distribute profits fairly.

Strategic Planning for Success

Strategies like phased development can manage cash flow effectively, while pre-selling can help gauge market interest. These strategies minimize financial risks and optimize operational efficiency, boosting the venture’s profitability.

If these strategies for profit maximization interest you, consider reaching out for specialized consultation. As experts in real estate joint ventures, we offer a comprehensive range of services spanning every joint venture stage, from ideation to successful execution. Contact us to explore collaborative opportunities that can transform your property into a high-yield real estate investment.

2 replies on “Joint Venture Setup in Philippine Real Estate Development”

How much do you charge to provide a sample joint venture contract and how much do you charge for designing a townhouse development of a piece of land?

We appreciate your interest! To help us best understand your project needs, please feel free to send your inquiries through our contact form at https://www.ianfulgar.com/contact/