In the fast-evolving Philippine real estate sector, developers and investors frequently engage in collaborative efforts utilizing various business models to enhance project efficiency and mitigate risks. Consortiums and joint ventures, two prevalent approaches, offer specific advantages tailored to distinct project requirements. Although many in the industry use these terms interchangeably, consortium vs joint venture differ significantly in structure, legal implications, and operational dynamics. These disparities profoundly impact real estate projects, particularly within the Philippines, where partnerships often determine the success or failure of large-scale developments, underscoring the significance of these collaborative approaches.

Comprehending the detailed distinctions between consortiums and joint ventures is essential, surpassing mere awareness of their divergence. Understanding plays a crucial role in making well-informed decisions, potentially influencing aspects ranging from project financing to risk management and allocation. In the subsequent sections, a comprehensive examination of these differences is undertaken, mainly focusing on the relevance of each structure to real estate ventures in the Philippines.

Consortium

A consortium is an association of two or more entities (individuals, companies, or organizations) that collaborate for a common purpose, typically to pool resources for a specific project. Key characteristics of a consortium include:

- Independence: Each member retains a separate legal status and operates independently outside the consortium’s activities. Members are only responsible for obligations defined in the consortium agreement governing their collaboration.

- Flexibility: Consortiums often have a more flexible and decentralized structure. They do not create a new legal entity. Instead, they operate under a contractual agreement outlining each member’s roles and responsibilities.

- Expected Goals: Members work together to achieve specific objectives, such as bidding on large-scale projects, without merging their operations or resources beyond what is necessary.

Joint Venture

A joint venture, on the other hand, is a more formal arrangement where two or more parties create a new legal entity to pursue a shared business goal. Key features of a joint venture include:

- Shared Ownership and Control: Participants contribute resources (capital, expertise, etc.) and share ownership, risks, profits, and governance of the new entity. This arrangement often involves a more integrated approach to management and decision-making.

- Legal Entity Formation: A joint venture typically results in forming a new legal entity, which can own assets, enter contracts, and conduct business in its name. This structure allows for a more precise delineation of responsibilities and liabilities among the parties involved.

- Long-term Collaboration: While parties can establish joint ventures can be established for specific projects, they often involve ongoing business relationships, allowing participants to leverage each other’s strengths over a longer duration.

Risk And Profit Allocation

The allocation of risk and profit is a fundamental difference between consortium vs joint venture in real estate. In a joint venture, the risks and rewards are shared equally or proportionally among the partners based on their stake in the project. This shared responsibility allows the involved parties to distribute financial risks while working toward common goals.

For example, suppose a foreign investor enters a joint venture with a local real estate developer in the Philippines. In that case, both parties share the risks associated with construction delays, cost overruns, or market fluctuations. They also share in the profits, with dividends distributed according to their agreed-upon stakes.

In a consortium, however, the risk allocation is tied directly to each partner’s scope of work. Each entity bears responsibility only for its portion of the project, with no obligation to share in the overall risk of the venture. If one party fails to deliver, the others remain unaffected financially, as they are not obligated to cover the losses of their partners. In this arrangement, profit-sharing also remains confined to individual performance. One consortium member may profit from the successful completion of its part of the project, while another incurs a loss due to poor execution.

The unique characteristics of consortiums make them well-suited for complex projects in which risks are distributed unequally across various work segments. For example, in a real estate development consortium, one company might specialize in material sourcing, another in construction, and a third in marketing. Each party accepts accountability for its success or failure, leading to a more decentralized approach to risk management.

Decision-Making and Control in Consortium vs Joint Venture

Another significant difference between a joint venture and a consortium is decision-making authority. The venture’s management operates as a unified entity in a joint venture. A project manager, often appointed by consensus, oversees the entire project and ensures all partners work toward the same goal. The centralized structure allows for more streamlined decision-making, enabling quick adjustments when necessary.

In a consortium, decision-making remains decentralized. Each partner retains control over its portion of the project and has its management team. The consortium may appoint a coordinator or lead entity to oversee communication and coordination between the various parties, but this leader needs binding decision-making power. Each partner must approve any significant changes or decisions before implementation. This process can result in slower decision-making processes compared to a joint venture.

Joint ventures in Philippines real estate business typically work well for projects that require fast execution and a unified vision. For example, in high-demand residential developments, where market timing is critical, the speed and efficiency of joint ventures often provide an advantage. Conversely, consortiums suit projects with multiple phases or technical requirements where the input of different specialized entities is necessary.

Consortium Vs Joint Venture Financial And Tax Implications

From a financial perspective, joint ventures offer a consolidated approach to budgeting and accounting. The joint venture creates a shared bank account, manages all project finances, and distributes profits or losses accordingly. This arrangement’s financial transparency simplifies the auditing and taxation process, as the joint venture files a unified set of financial statements.

Conversely, consortium members maintain separate financial accounts. Each partner invoices for its work and handles its taxation, meaning there is no centralized financial management. This independence provides flexibility but can also create complexities in larger projects. For example, the lack of a single economic entity can lead to disputes over how much each partner should contribute to shared expenses, such as marketing or insurance.

Consortium vs joint venture in the Philippines are subject to different tax regulations. A joint venture’s income is taxed based on collective earnings, while consortium partners file taxes independently based on their contributions and profits. These tax implications can influence the choice between a joint venture and a consortium, depending on the financial goals of the involved parties.

Consortium vs Joint Venture Real Estate Applications in the Philippines

In the Philippine real estate market, joint ventures and consortiums have proven successful in different contexts. Joint ventures are common in high-value developments, such as luxury condominiums, where investors, landowners, and developers aim to capitalize on the growing demand for premium housing. These ventures allow for streamlined project management and shared financial risk, appealing to foreign investors who require a trusted local partner to navigate the complexities of the Philippine market.

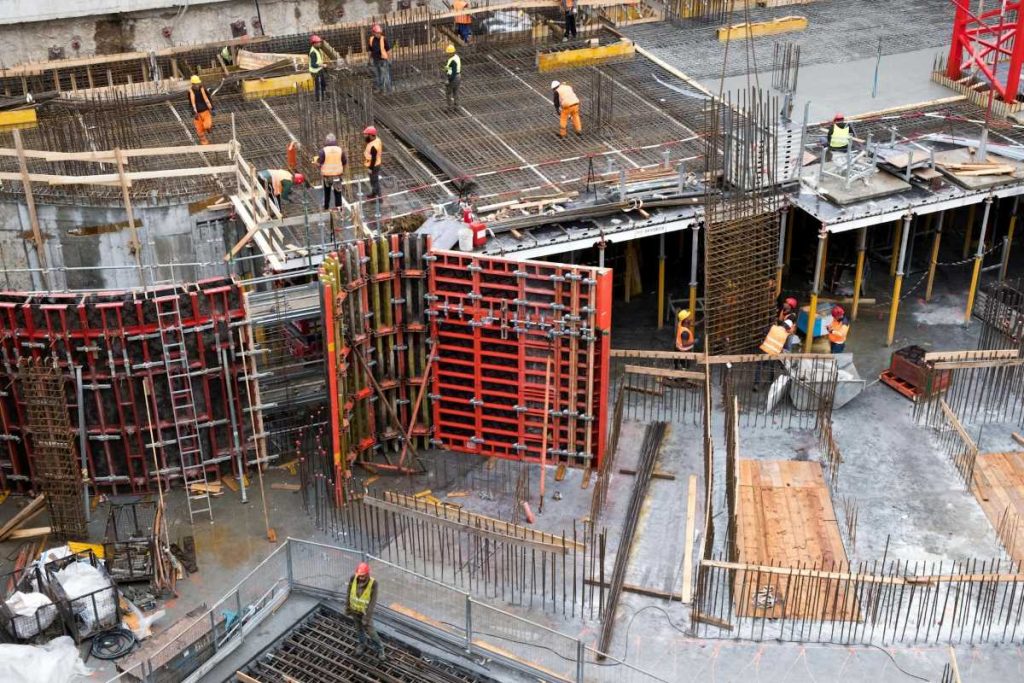

The development of large-scale infrastructure and mixed-use projects commonly utilize a consortium setup. These endeavors necessitate input from multiple sectors, including construction, finance, and urban planning, making a consortium’s flexibility advantageous. Each partner brings specialized expertise, and the decentralized structure enables greater autonomy in decision-making.

The choice between consortium vs joint venture ultimately depends on the project’s size, complexity, and risk profile. For developers in the Philippines, understanding the differences between these models is crucial for structuring partnerships that meet the unique demands of the local market.

Strategic Partnerships in Real Estate Development

If you are a landowner or investor exploring joint venture opportunities in Philippine real estate development, I encourage you to connect with me to discuss strategic partnerships. By combining resources and expertise, we can leverage the market’s potential and co-create high-value projects that benefit from a collaborative vision and shared success.

Additionally, I am actively seeking partners for those interested in forming a consortium that requires comprehensive estate planning and management for larger developments. Let’s explore how we can jointly drive project execution, capitalize on market trends, and ensure effective management for long-term profitability.